Family Gift of Precious Coins From Outside Us

There's nothing quite similar property a golden coin in your hand. And owning some real aureate offers a number of advantages you lot just can't get with other investments. And since aureate is a natural hedge against the stock market, it's an excellent mode to diversify, too.

This article volition cover the basic do's and don'ts of buying golden coins, including the advantages of owning them, the best gold coins to buy, the best places to buy (including if y'all should buy online or on eBay), and how to avoid getting ripped off. With a few simple guidelines you lot'll be on your way to owning one of flesh'due south longest-living assets.

This guide to investing in golden coins will seek to respond some of the common questions we hear including:

- Why buy gold coins?

- How & where to buy?

- Which gold coins should you lot buy?

- Should you invest in numismatic gold coins?

- What are the most popular gold coins?

- Can yous buy gold coins from a depository financial institution?

- What'due south the best place to buy? Can you trust online dealers?

Let's start with something about gold coins that many investors aren't enlightened of…

The Many Reasons for Buying Golden Coins

Golden offers benefits far beyond the fact that its cost can rise.

Considerable all the advantages you gain past ownership gold coins. Gold is…

• A tangible asset. Y'all can hold $50,000 of gilded coins in your hand, which you can't practise with most any other investment. It can't be destroyed by burn, water, or even time. And unlike other commodities, gold coins don't need feeding, fertilizer, or maintenance.

• Gratis of counterparty run a risk. Gilt coins require no paper contract to be made whole. Gold is the only financial asset that is not simultaneously some other entity's liability. Information technology doesn't require the bankroll of any banking concern or government.

• Highly liquid. Gold coins can be sold most anywhere in the earth. At that place are golden dealers in only near every major city on the planet. And in a crunch, gold will be in high demand. Other collectibles, like artwork, accept longer to sell, have a smaller client base, and will probable entail a big commission.

• Value dense. You tin can concord $50,000 in gold coins in the palm of your mitt. Gilt coins take upwardly such little infinite that you can store more value of them in a safe eolith box than stacks of dollar bills.

• Private and confidential. How many assets tin you say that about in today's world? You must pay taxes on any gain, of class, but if you desire a footling privacy or confidentiality, only purchase some gold coins!

• Portable. You can take gold coins with you wherever you go in the globe.

• A store of value. The gold cost fluctuates, of course only its value is timeless. Consider that gold retains its purchasing power over long periods of time, while the US dollar, for instance, has lost 98% of its purchasing power since the creation of the Federal Reserve in 1913. And since gold will outlast you lot, it is an platonic asset to laissez passer on to your heirs.

By the fashion, it's a faulty argument that gold doesn't produce any income. That'southward non gilt's office in your investment portfolio. Its function is equally money and a store of value, similar to a currency. That's besides why it shouldn't be viewed as a article; it doesn't get used up, like oil or corn. In other words, gilt is money!

• Can't be hacked or erased. It's probably not a good thought to keep all your wealth in digital form today. That'due south easy to practice if you own some gilded coins.

• Requires no specialized cognition. If you lot don't know how to spot a real diamond, aren't familiar with the painter Van Gogh, or don't collect comic books, just buy some golden bullion. No special skills or training needed.

• Comes with low maintenance and carrying costs. Fifty-fifty if you pay for storage, compare that to the costs and taxes and headaches of, say, real estate. You don't fifty-fifty need a stock banker to buy and sell gold coins.

The Best Gilded Coins to Purchase

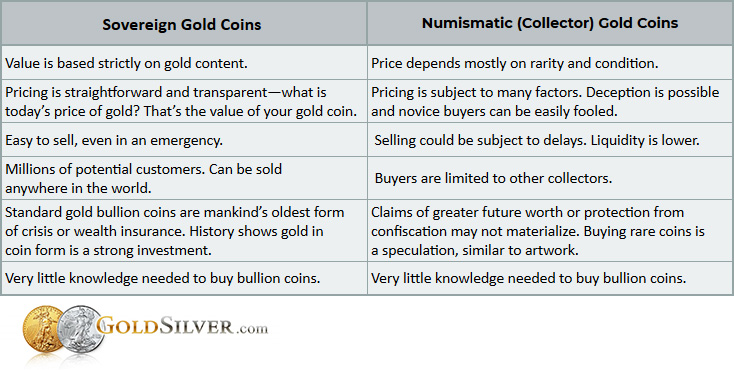

There are a lot of gilt coins on the marketplace. But they all fall into ii basic categories: standard bullion coins, or numismatic (rare) coins.

Bullion coins simply refer to gold coins that are made almost exclusively from precious metallic, in this case aureate. Their attraction is that they consist of highly refined gold and are viewed primarily every bit an investment. Some bullion coins accept an alloy to make the coin more than durable, since gold is a "soft" metal. Bullion coins are not regarded as a "collector" coin, which is a unlike course of coin (though all gold is taxed as a collectible).

You tin can purchase bullion coins from a number of government mints that produce them each year. These are generally referred to every bit "sovereign" coins, meaning they are manufactured (and in well-nigh cases guaranteed) by that government. They also come with a face value (except the S African Krugerrand). These face values are mostly symbolic at this point, since the gilt content of the coin makes them worth a lot more than the value printed on the money. Only each government guarantees they will always be worth the amount stated.

Private mints besides brand gold coins, chosen "rounds." While commonly of proficient quality, they don't come with a face up value or the same regime backing. This makes them less attractive than sovereign gold coins, and thus the popularity of gold rounds is express not loftier (this is non the instance for argent rounds).

Numismatic coins refers to rare coins, ones that are bought and sold by collectors. Unlike bullion coins, their value isn't based on the aureate content, merely rather on their rarity and condition. Their premiums (or mark-ups) are usually much higher than bullion coins, and can stretch into the thousands of dollars (and in some cases, millions!).

The best rule of pollex on whether to buy numismatic coins is this:

• Unless you lot plan to become a coin collector, avoid numismatics and their higher premiums.

The reason is simple: if you don't know what you're doing, it's easy to pay a whole lot more than you lot should. Some dealers will try to convince you to buy them, claiming they'll someday be worth more or would be exempt in a confiscation. These things may or may non come to laissez passer, then these arguments are actually just sales tactics. The bigger reason they want to talk you out of bullion coins and into rare coins is because they make a lot more money on them! Sales commissions are much higher on numismatics, which of grade you pay for. My advice is don't go talked into rare coins (or if you'd similar to collect celebrated coins, get educated first).

Proof coins are another course of numismatics. These are high relief coins and are very heart-appealing, merely also come with high markups. Again, these are geared for collectors, and unless that'due south what y'all want to be, yous don't demand to buy these when yous invest in gold.

"Semi-numismatic" coins is another term you might hear. This is more of a marketing term than anything else, and basically refers to gilded coins (and more frequently silver coins) that are made to exist collector coins simply don't even so have the historical significance of a true numismatic. They may or may not be worth more someday, simply should non exist viewed as a replacement for bullion. They are nonetheless part of the collector's globe, and as such you lot volition pay more than for them than standard bullion.

Considering money collecting is a different animal, in that location are many coin dealers that don't sell numismatic coins at all (including GoldSilver). They don't offer collector coins because, well, they're not collectors, and also considering they simply don't experience comfortable selling over-priced products to investors when all well-nigh investors need is bullion.

By the style, you'll sometimes run into a money marked "BU." This stands for "Brilliant Uncirculated." It merely means it's a brand new coin, never before sold. If you're buying the current year coin, it volition be BU. Past years can be BU, too, if they were never sold. These older-dated gold coins are usually referred to as "common date" coins, or listed on a website equally "twelvemonth of our choice." Once again these are fine if they're BU. If a money is not BU, you might likewise look for i that is, since they're plentiful. All of our gold coins here at GoldSilver.com are BU.

There'due south i more element that will help united states identify the best gold coins to purchase—and that's existence prepared to sell…

As an investor, you want to purchase something that won't just ascension in value, simply that will also be like shooting fish in a barrel to sell. That'southward generally easy to practice in the stock market, as near stocks are highly liquid. But you've probably heard that some stocks have very low book, which can make them tricky to sell. The same thing is truthful with gold coins: yous want a grade of coins that volition be easy to sell. Y'all want to avert a product that could experience a delay when it's sold, or price y'all more than you expected, or won't have a lot of buyers.

And those are exactly the concerns with rare coins. You lot could feel delays when you effort to sell them—the dealer or buyer might want to confirm its value or authenticity, for example. Or they may offer y'all less premium than you paid. Or they may not desire to buy information technology at all. On top of this, you accept a much smaller pool of interested customers, as many investors are not money collectors.

Sovereign coins, on the other hand, are easily recognizable literally the world over, can always exist sold for the toll of gold, and will have enough of customers.

Add information technology all up and…

• All investors should kickoff by buying sovereign gold coins.

Government (sovereign) coins are the nearly widely known around the world and thus volition be the easiest to sell. Even if you don't sell them simply laissez passer them on to your heirs, they will demand something that'southward easy to sell.

So the golden dominion when buying gold coins is this: buy the nigh common or pop items, so that you have high liquidity when the time to sell comes.

Hither'southward a summary tabular array of the differences between bullion coins and collector coins:

It'due south easy to see that the average gold investor should stick to, or at to the lowest degree start with, mutual bullion coins.

Now that nosotros know nosotros should buy sovereign coins, what exactly practise we start with?

The Almost Popular Gold Coins

The most popular sovereign gold coins in the earth are the post-obit vi. Some are 22-karat and most are 24-karat, but they all contain a total ounce of gilt. You'll see their content (gold) and purity (every bit stated on the coin) are guaranteed by a government, and other than the Krugerrand, are all legal tender in the state of outcome. They're as well all eligible to put in your IRA…

One Ounce American Gold Eagle

Purity .9167 (22-karat)

$50 face value

Backed by: United States government

Can also be bought in half, quarter, and tenth-ounce denominations

Special Note: Most popular golden coin in the earth

Purchase the ane Oz Gold Eagle

1 Ounce Canadian Maple Leaf

Purity .9999 ; $50 Canadian face value

Backed by: Commonwealth of Canada

Can also be bought in half, quarter, tenth, and twentieth-ounce denominations

Special Note: Royal Canadian Mint'south avant-garde security measures brand this the near secure gold coin in the world.

Buy the 1 Oz Golden Maple Foliage

One Ounce Austrian Philharmonic

Purity .9999

Backed by: Democracy of Austria

Can besides be bought in half, quarter, tenth, and twentieth-fifth-ounce denominations

Special Notation: Widest money currently made; until 2001, was the world'southward top selling gold coin

Purchase the ane Oz Combo

One Ounce Australian Kangaroo

Purity .9999

$100 Australian confront value

Backed past: Australian authorities

Can also be bought in half, quarter, and tenth-ounce denominations

Special Note: The Perth Mint produces a new depiction of the Kangaroo every year

Buy the ane Oz Kangaroo

One Ounce South African Gold Krugerrand

Purity .9167 (22-karat)

No confront value

Backed by: Government of Due south Africa

Can also be bought in half, quarter, and tenth-ounce denominations

Special Notation: Oldest circulating bullion money in modern history

Buy the 1 Oz Krugerrand

I Ounce American Gold Buffalo

Purity .9999

$50 face value

Backed by: United States authorities

Special Note: The newest sovereign money, outset manufactured in 2006; greater purity than the Eagle.

Purchase the 1 Oz Gold Buffalo

If you want to own pure gold, coins are a skillful place to start. You'll take beautiful coins, backed by a sovereign regime, which can easily exist sold when the need arises.

I recommend ownership one-ounce denominations, because the premiums are college on partial coins. But if you lot tin can't afford a full ounce, some gilded is certainly better than no gilded.

This isn't to say that you should never purchase other coins. The point is that every investor should have a meaningful stack of these before buying annihilation else. These gold coins are your golden safety net, you and your family's budgetary insurance hedge that can easily exist sold if the need arises.

At present that we know what to buy, allow'south observe out where to shop…

The Best Places to Buy Golden Coins

Most gold coins are bought in one of two places: at a local money store, or online. (There are a few other places, also, which we'll address below.)

Believe it or not, you'll likely find better pricing online than at a money shop, even after factoring in shipping costs. That's because the overhead at a brick-and-mortar store is higher. Just that'due south just function of the departure betwixt them.

Here's the pros and cons of your two basic options…

Local Coin Dealer

Even if you decide to purchase online, I recommend checking with a local dealer, because a relationship with them can be helpful if you need to make a quick auction. If you decide to purchase from them, see if they'll negotiate on toll.

Where to find a local dealer…

The easiest starting point is to employ this Us Mint dealer locator.

Y'all can besides Google "money dealer" and your city or county. Adding the discussion "gold" may not aid, as some dealers similar to keep a low profile.

If y'all're in Asia or Europe, check to run across if your banking concern sells aureate coins.

Online Dealers

Buying from an online seller comes with one obvious risk: yous gotta pay upfront, and then trust that the dealer delivers what you purchased. But this isn't usually an issue with a well-established online dealer—the terminal thing they want is for word to get around that they ripped someone off.

And equally I said, ane advantage to an online dealer is that they can ofttimes be cheaper than a local store, even afterwards aircraft and insurance costs.

When choosing an online dealer, look to run into product prices displayed on the site, along with shipping and insurance charges (you may have to search for these fees). A dealer that doesn't show prices isn't necessarily bad, only sometimes that means they desire you to phone call so they have the chance to sell you lot as much every bit possible. Equally a result, give greater weight to transparent dealers.

Last, look for a delivery time frame before you place an order.

Here are the pros and cons of ownership from an online dealer:

Choosing the All-time Dealer, Online or Local

A good way to offset is to compare prices of the same product among a few dealers.

Getting a low premium is good, of course, just cost isn't the simply consideration. Hither's a few other important questions to ask:

• Do they offer multiple forms of payment? Bank wire, credit card, cash, personal checks, money orders/cashier'southward checks, and PayPal are existence increasingly offered in the gold industry. And you desire every bit many options as possible for not just current orders but future ones, too.

• What are total costs, including committee, aircraft, insurance, and credit bill of fare or depository financial institution wire charges?

• How big is the company? Yous want a dealer that has strong volumes, considering they will have greater flexibility, bigger choice, and be more equipped to fill a big buy or sell lodge.

• Is the dealer pushy, or educational? Do you lot feel comfortable with them?

• Will the dealer send y'all a lot of marketing materials later on your purchase? Yous may want these to learn about special offers, but you don't want to get bombarded or your name be sold.

• Practice they offer a buyback policy? If they're not willing to buy back what yous purchase today, that's a strike confronting them. We obviously desire a dealer that will still be in business years from at present when you're ready to sell.

• What is the return policy if yous receive the wrong production? Continue in listen, all the same, that you can't return a correctly filled order due to "buyer remorse."

There are a few other places you'll see gold coins for sale, including…

Television Dealers

It's hard to watch cable television and not run into an ad from 1 of these dealers. Merely I avoid them because:

• They're most always more than expensive. Many of them pay huge advertising and/or glory endorsement fees.

• They usually have minimums, which may exist greater than you want to buy. Or they may arrive very expensive to purchase a small lot.

• They usually try to talk you into ownership numismatic coins, or more product than you want.

• They offer quirky and expensive payment plans, such every bit the "layaway program" that charges involvement until you pay in full.

You tin can avoid most of these tactics past non calling them in the offset place.

eBay

I have friends that prefer buying their gold coins on eBay. It'due south convenient, and shipping is usually costless. The run a risk is that your trust quotient is forced way upwardly, since you're usually buying from a private party (some dealers post products on eBay).

Since many eBay buyers are investors who know exactly what they want and know a good bargain when they see information technology, I recommend you don't start with eBay until y'all get more experience and noesis about gold coins. Information technology's not likely that a private party will beat an online dealer by much anyway, since premiums on gold bullion coins are mostly depression.

Coin Shows

Nearly coin shows focus on collectible coins, not bullion. I've been to many shows over the years and frequently can't observe a one-ounce gilt Eagle (the virtually mutual coin in the world)! You also have to travel to the prove, which takes fourth dimension and expense.

Ownership at a coin show is not for the novice and not an ideal way to buy bullion.

Can I Buy Coins From My Depository financial institution?

Depends where you live. If you're in Europe or Asia, check with your bank. Some banks offer gilded products to retail customers. I know several people that have done this very affair in Switzerland, for example.

To find out if a banking concern offers gold coins for auction, only give them a telephone call (it may or may not be well-advertised on their website, for security reasons). One caution: brand sure you compare premiums, so that yous're not existence overcharged. Also, ask if they offer lower rates to existing customers.

If y'all alive in the U.s.a., it is a common misconception that you can buy golden at a banking company. Many people expect a bank to effect aureate, harkening back to times of old, but today most physical aureate is purchased from not-bank distributors. Even the United states of america Mint requires retail customers go through an "authorized purchaser" (unless you want a proof production).

Don't Get Ripped Off!

The #1 fashion to avoid getting ripped off when ownership gilt coins is to shop at a highly reputable dealer. They will sell only quality product that comes from an authorized distributor of the government mint.

And the style to notice a reputable dealer is to follow the checklist above. Your bones goal the kickoff fourth dimension through is to do plenty of your ain due diligence so that you have a place to return the side by side time yous're ready to buy. So…

Check a company's reputation and complaints at the Better Business organisation Bureau or Trustpilot. Bank check the peer reviews. Here is GoldSilver'due south TrustPilot rating:

Understand all your costs upfront—commissions, aircraft, insurance, and any actress charges for credit cards, bank wire transfers, etc.

Await for those that have a guaranteed buyback policy. You're looking for a dealer who's not just willing to repurchase what they sell you, only one that is probable to remain in business concern. You lot could ask what their "buy" prices are at present on the product yous're thinking of purchasing to gauge how off-white their future prices may be.

Whatever y'all do, buy! You'll love the weight of existent aureate in your hand, and will possess a real asset that tin last generations and protect your portfolio against whatsoever the economy and markets may throw at you.

Buy Gold Coins

Interested in Silver coins? Read our guide on How & Where to Buy Silver Coins.

Source: https://goldsilver.com/blog/how-where-to-buy-gold-coins/

0 Response to "Family Gift of Precious Coins From Outside Us"

Post a Comment